Do you need to determine if you’re eligible for food stamp benefits in Florida? If so, we have got your back. We explain to you the 2024 Florida food stamps income limit. The Florida food stamps income limit decides whether you meet the Supplemental Nutrition Assistance Program (SNAP) requirements. This project is commonly referred to as food assistance or food stamps.

Where Can I Apply for Snap Benefits?

You may apply online or in person. The offline service is available at the DCF center or with DCF community partners.

Also, you may mail or fax them an application. We give you the address below –

P.O. Box 1770

Ocala, FL 34478-1770

How Much Can I Get from Florida Food Stamps?

Get a monthly amount depending on your household extent by meeting all eligibility criteria for benefits. This chart shows your maximum SNAP benefit allotment –

| Household size | Highest SNAP benefit |

| 1 | $281 |

| 2 | $516 |

| 3 | $740 |

| 4 | $939 |

| 5 | $1,116 |

| 6 | $1,339 |

| 7 | $1,480 |

| 8 | $1,691 |

| Per additional members | +$211 |

The Florida Food Stamp Program has stringent qualifying criteria. An application for food assistance must fulfill all the eligibility criteria. This will guarantee that your SNAP application is submitted correctly and accepted. Let’s dive into the 2024 fiscal year Florida food stamps income limit chart.

Income Limit for Florida Food Stamps

The Florida Food Stamps income limit determines the acceptance of your SNAP application.

You must calculate your household’s total monthly gross income before using the SNAP income limit chart.

Your total gross income is then compared against a specified percentage of the federal poverty level (FPL). These figures establish if you are eligible for Florida Food Stamps.

Once you have outlined your household’s gross income, deductions such as childcare expenses, medical expenses, and housing costs are made to tally your total net income.

Your household’s total net income then reveals the amount of FL SNAP benefits you’ll receive each month.

Moreover, we will help you generate your gross and net monthly income, including standard and allowable deductions for your household.

2024 Florida SNAP Income Limit Chart

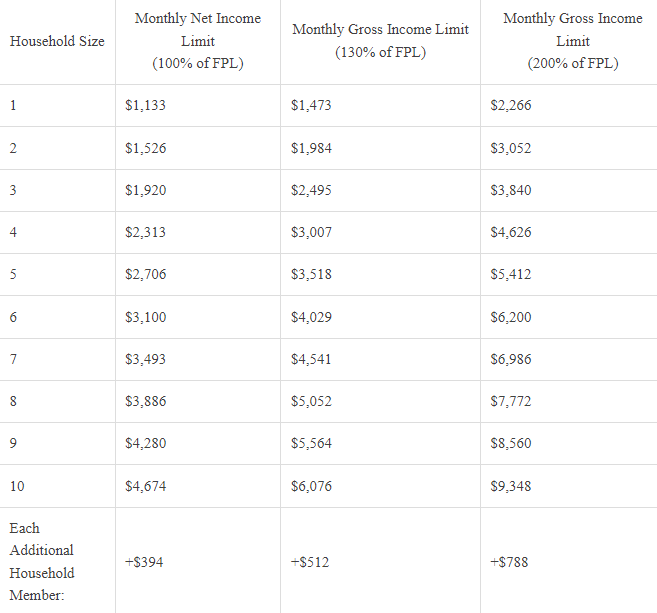

The 2024 Florida Food Stamps Income Limit is determined by your household’s total income and size (number of household individuals). It considers your household size against Federal Poverty Level (FPL) earnings.

The Florida SNAP Income Chart presented below displays both the gross monthly income and the net monthly income.

This income limit chart is valid from October 1, 2022, to September 30, 2024.

What is the maximum income for Food Stamps?

The maximum income you can receive for food stamps is 130% of the current Federal Poverty Level (FPL). The Food Stamps Income Ceiling changes according to your household size.

For instance, the highest income for food stamps for a household of four is $3,007 per month.

2024 SNAP EBT Net Income Limit

With a few exceptions, all households applying for Florida Food Stamps must also meet the net monthly income limit.

You must subtract allowable deductions from your monthly gross income to determine your net monthly income.

A list of allowable deductions for SNAP EBT is below to assist you.

Allowable Deductions for SNAP EBT

Allowable expenses that can be deducted from your gross income include –

- Earned income gets a 20% deduction.

- A dependent care deduction for individuals during work, training, or education purposes.

- A standard deduction of $193 applies to 1-4 individual households. However, the amount is $258 for households with six or more individuals.

- A deduction for legally bound child support payments.

- A deduction for medical expenses exceeding $35 per month for elderly or disabled individuals.

- A shelter cost deduction of $166.81 for homeless households.

- If more than half the household’s income goes to shelter costs, you may deduct the excess. But the shelter costs cannot go beyond $624. Shelter expenses involve mortgage or rent, & utilities.

The Florida SNAP Standard Deduction for 2024

The standard deduction for Florida food stamp eligibility calculation is determined by the household size and location. So this deduction chart presents an idea of the subtractable amount from your total household income.

| Household size | Standard deduction |

| 1-2 | $193 |

| 3 | $193 |

| 4 | $193 |

| 5 | $225 |

| 6+ | $258 |

SNAP EBT Regarding Excess Housing Deduction

When determining your household’s monthly net income, an excess shelter deduction activates for shelter expenses exceeding 50% of the total income. It applies only after subtracting other deductions.

Supported shelter expenses may involve –

- Fuel for heating and cooking.

- Cost for one telephone.

- Electricity.

- Water.

- Homeowners’ taxes.

- Rent or mortgage payments (and interest).

- Fixed amounts for utility costs instead of actual costs.

Last Words:

You can apply for Florida Food Stamps in four ways, as we have stated at the top. You need your social security number, personal information, income statements, asset information, residential costs, and health insurance details. You receive EBT (electronic benefit transfer) under the My Access Florida program if you are eligible for benefits.

Leave your comments or questions below for the experts to reply.