Your income level effectively determines your Supplemental Nutrition Assistance Program (SNAP) eligibility in Florida. In this article, we explain the Florida Food Stamps Calculator for 2024. So you can self-calculate how much you will receive in SNAP benefits if approved.

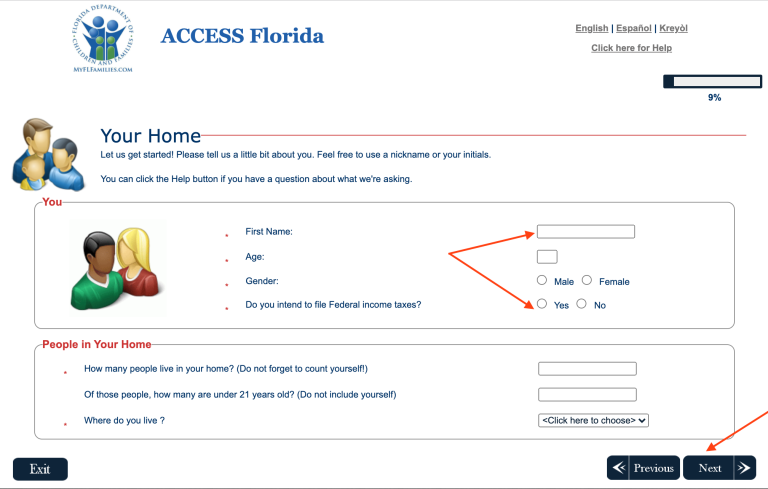

Note: Potentially eligible applicants for Florida Food Assistance can use the pre-screening tool on the ACCESS Florida website. It can determine if you qualify for food stamp benefits. Create an ACCESS account and start an application. This process sorts out everything for you in one go.

Florida Food Stamps Calculator in 2024

Let’s take a sample family for a clear understanding. We break down the SNAP calculation process into five simple steps.

A family of three with one full-time minimum wage worker, two children, monthly child care costs of $65, and shelter costs of $1,222.

- Gross Income: The federal minimum hourly wage is $11. Full-time work brings you $1,907 per month.

- Net Income after Deductions: So your gross monthly income is $1,907. Now, we must subtract three expenses from this total amount.

- The standard deduction for a three-person household is $193.

- The earnings deduction is 20 percent of $1,907 equals $381.

- The childcare support is $65.

Therefore, your countable income is $1,907 – ($193 + $381 + $65) = $1,268.

- Net Income after Shelter Deduction: Your actual shelter cost is $1,222. The shelter deduction cap is $624, and you can claim the maximum deduction in this instance. Your countable income is $1,268.

Hence, your net income is $1,268 – $624 = $644.

- Food Contributions: The expected food contribution in a Florida household is 30 percent of the net income of $644. So the food cost deduction is $193.

- SNAP Benefit: The maximum SNAP/EBT benefit is $740 in 2024 for a Floridian household of three. You have to subtract your expected food contribution from the maximum benefit amount.

So your Florida Food Stamps allotment is $740 – $193 = $547.

Note: However, this simplified SNAP calculator version does not give you the ultimate verdict in this respect. You must apply for food stamps benefits in Florida regardless of any outcome here.

Also, you may visit a SNAP calculator for an in-depth analysis of your food stamps eligibility.

Note: The following picture shows you the factors that matter in SNAP calculation.

Gross Income Test

Count in all your monthly household income before tax deductions. This total involves your salary, self-employment earnings, and other revenue sources such as social security, disability payments, child support, worker’s compensation, unemployment benefits, and pension income. The gross income limit in Florida is 130% of the federal poverty level.

| Household Individuals (Persons) | Gross Income Limits (Monthly) |

| 1 | $1,473 / month |

| 2 | $1,984 / month |

| 3 | $2.495 / month |

| 4 | $3.007 / month |

| 5 | $3,518 / month |

| 6 | $4,029 / month |

| 7 | $4,541 / month |

| 8 | $5,052 / month |

| Each additional person | +$512 / month |

Also read: SNAP Income Limit

Household Size-Wise Food Stamps Benefits in Florida

Besides, we must identify the highest potential benefits a household could receive. The United States Department of Agriculture sets this amount annually. The following table shows the maximum monthly benefits in 2024 based on your household size.

| Household Size | Maximum Monthly Allotment |

| 1 | $281 |

| 2 | $516 |

| 3 | $740 |

| 4 | $939 |

| 5 | $1,116 |

| 6 | $1,339 |

| 7 | $1,480 |

| 8 | $1,691 |

| Each additional person | +$211 |

Allowable Deductions for SNAP EBT

Allowable expenses that can be deducted from your gross income include the following –

- Earned income enjoys a 20% deduction.

- A dependent care deduction for individuals during work, training, or education purposes.

- A standard deduction of $193 applies to 1 – 4 individual households. However, the amount is $258 for households with six or more individuals.

- A deduction for legally bound child support payments.

- A deduction for medical expenses exceeding $35 per month for elderly or disabled individuals.

- A shelter cost deduction of $166.81 for homeless households.

- If more than half the household’s income goes to shelter costs, you may deduct the excess. But the shelter costs cannot exceed $624. Shelter expenses involve mortgage or rent, & utilities.

Potential Food Assistance Receivers & Benefits Uses

Recipients: Florida food stamps could offer crucial relief for impoverished households. It can ease up your financial hardships in affording food. Eligible households in Florida receive monthly cash benefits through the program.

Uses: You can use the SNAP/EBT benefits to purchase eligible food items at various locations, including grocery stores, markets, and gas stations. The Florida Department of Children and Families runs this cash assistance project under the ACCESS Florida Program.

Image credit: SNAP

SNAP EBT Regarding Excess Housing Deduction

When determining your household’s monthly net income, an excess shelter deduction applies for housing expenses exceeding 50% of the total income. It applies only after subtracting other deductions.

Supported shelter expenses may involve –

- Fuel for heating and cooking.

- Cost for one telephone.

- Electricity.

- Water.

- Homeowners’ taxes.

- Rent or mortgage payments (and interest).

- Fixed amounts for utility costs instead of actual costs.

Last Words

This blog illustrates the calculation process and the income limit for Florida Food Stamps. We encourage you to apply for the benefits anyway. If you still need any help, leave a comment below. We will get back to you in no time. Also, we ask you to share this write-up with potential applicants.